May I know how many bank will you submit for your house loan applications? Do you have fear to apply for multiple banks?

Normally after placing the booking fees, the next step will be applying loan from bank. Unless you are buying with your hard cash, then this article is not relevant to you already.

In my past experience, always apply for multiple banks for few benefits.

Benefit of multiple bank applications

- Increased the chance of approval

- Comparison for each loan

- Get the best deal in town in term of tenure and interest rate

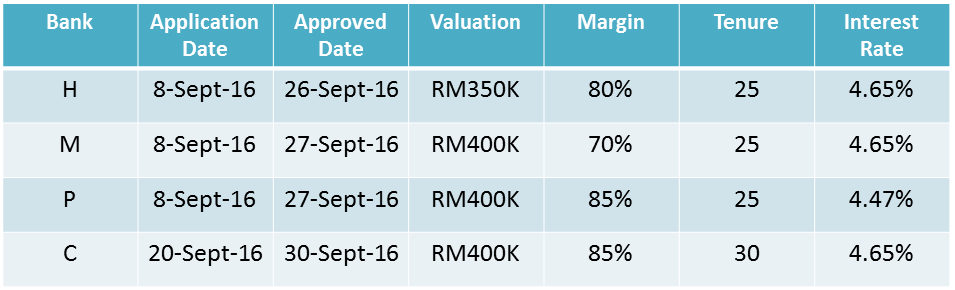

Sharing with you the recent experience commercial property loan applications to multiple banks.

After the booking form is signed, immediately contacted 3 banks namely Bank H, Bank M and Bank P.

All the bankers asking me to prepare the following document since I am salaried personnel.

- National Identity Card (NRIC)

- 3 months payslip

- Banks statement that showing salary is credited

- EPF 2016

- EA form for 2 years (if have)

- Property details/booking form

Without delayed, all the documents submitted on the next day to all 3 bankers.

To my surprised that all the 3 banks not able to provide the reply in 14 days. The first bank to drop out from my list is the Bank H since the valuation is only RM350K whilst my purchased priced is RM400K.

Knowing the risk of not getting approved, I have to reach out another banker C and apply through him. His service is very fast and only took 10 days to approve the loan applications.

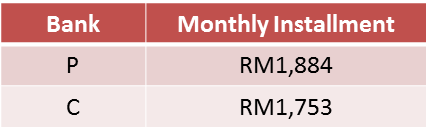

Based on the table above, which loan will you choose? Since Bank H already drop out, only left with Bnak M, P and C. The best rate provided are Bank P whilst the best tenure is offered by Bank C. Which means that Bank C has lower monthly installment. The different is RM131 in term of monthly installment. Refer to below table for comparison.

Which will you choose? Let me know why?

Teoh

Bank C. It has the longer tenure that lower monthly installment although the interest is higher than Bank P. Besides, it has faster approval, better valuation and margin.