Last week, a group of Six of my team make a several booking from the secondary market in Raja Uda, Butterworth area. After placing the deposit and signed the booking form, all of us are looking for bankers to proceed loan and get quotations for the legal fees. Basically there are two area of legal fees required to pay and Stamp Duty need to be factor in when you purchased your property.

Do take note that legal fees is paid on top of the property price you purchased. Legal fees is payable to the appointed lawyer who will prepare Sale & Purchase Agreement between purchaser and vendor. On other hand, Stamp Duty which also known as Memorandum Of Transfer (MOT) is payable to the government & collected by Lawyer on behalf of the government.

The 2 parts of Legal fees are:

- SPA legal fees

- Required to add in the stamp duty

- Loan Agreement fees

- Required to add in the stamp duty

How to calculate SPA legal fees?

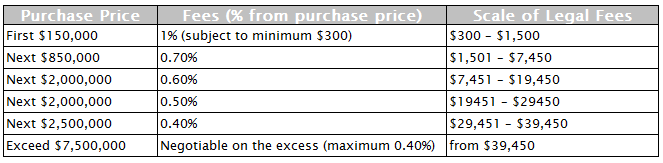

Lawyer fee for Sales and Purchase Agreement (calculated based on the SPA Property Price):

Example 1:

Purchased Price = $140,000

Legal fees = $140,000 x 1% = $1,400

Example 2:

Purchased Price = $350,000

Legal fees:

1st $150,000 = $150,000 x 1% = $1,500

2nd $200,000 = $200,000 x 0.7% = $1,400

Total = $1,500 + $1,400 = $2,900

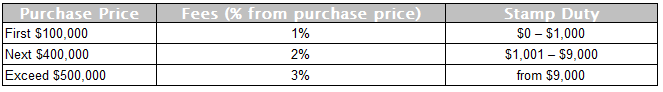

How to calculate SPA Stamp Duty?

Stamp Duty of Sales and Purchase Agreement (calculated based on SPA property price):

Example 1:

Purchased Price = $140,000

Stamp Duty = $100,000 x 1% + $40,000 x 2% = $1,800

Example 2:

Purchased Price = $350,000

Stamp Duty = $100,000 x 1% + $40,000 x 2% = $6,000

With above calculations, there is miscellaneous fee for preparation of Sales and Purchase Agreement. This could be at least a few hundreds tobe add on. From 1st April 2015 there will additional 6% government tax on total lawyer fee for Sales and Purchase Agreement.

How to calculate loan agreement fees?

If you are buying with cash, you do not need to factor in this loan agreement fees. Lawyer fee for Loan Facility Agreement (calculated based on mortgaged amount). The legal fees scale is similar to the SPA legal fees scale.

Example 1:

Purchased Price = $140,000

Mortgage amount = $140,000 x 90% = $126,000

Legal fees = $1,260

Example 2:

Purchased Price = $350,000

Mortgage amount = $350,000 x 90% = $315,000

Legal fees = $2,655

How to calculate loan agreement Stamp Duty?

Stamp Duty of Loan Facility Agreement (calculated based on mortgaged amount) multiply by 0.5%

Example 1:

Purchased Price = $140,000

Mortgage amount = $140,000 x 90% = $126,000

Stamp Duty = $630

Example 2:

Purchased Price = $350,000

Mortgage amount = $350,000 x 90% = $315,000

Stamp Duty = $1,575

Summary of Legal Fees and Stamp Duty Cost

Disclaimer: ChatPropertyMalaysia.com has made every effort to ensure the accuracy and correctness of the calculations, contents, information or data contained in this section. However, ChatPropertyMalaysia.com do not represent or warrant the truth, accuracy, completeness and correctness of the same. ChatPropertyMalaysia.com accept no liability for loss or damage suffered or incurred by you or your estate as a result of your reliance on the material above or howsoever arising from the use of the information or material presented herein. This page is intended for educational and general awareness purposes only and should not amount to any form of advice.

RAMESH SURYAVANSHI

DEAR SIR

I PURCHASE FLAT 1275000 SO HOW THE CALCULATE THE AGREEMNT FEE?

Chat Property Malaysia

AuthorDear Ramesh:

Agreement fees is the lawyer professional fees which varies.

As such you need to contact few lawyers firm and do comparison.

Or you may Google it and could find some reference.

gengai arasan

sir i purchase house for 260000.so how much the legal fee.this is i buy first house.

gengai arasan

did i have any discount.if have how much after deduction.

Chat Property Malaysia

AuthorI do not understand what do you mean by discount

Chat Property Malaysia

AuthorYou need to refer to your lawyer for details breakdown on the fees charged

Khairul

Hi Sir,

I need your advice. If I have 1 Semi-D(for parent to stay) and 1 Terrace House(for my family to stay).

The question is:

1. Can I purchase a Low Cost apartment or flat cost around: 100,000.00 and below?

2. If can how much loan I can gain?

3. Can all the stamp duty and fee to be absorb into the loan?

Kindly assist

Chat Property Malaysia

AuthorAnswer:

1. Can I purchase a Low Cost apartment or flat cost around: 100,000.00 and below? I do not think so as you already have Semi-D and Terrace house. Low Cost apartment is for those have income constraint to own a property

2. If can how much loan I can gain?

3. Can all the stamp duty and fee to be absorb into the loan. Not i know off.

FZ

How about the fee for a refinance apartment (RM280K)?

Annie

May i know what is the miscellaneous charges to be incurred if the purchase price at RM350k?

Chat Property Malaysia

AuthorHi Annie:

You need to contact your lawyer for further explaination.

Aini

I just got a buyer and sold my house at 500k. I have to appoint another lawyer to check on my behalf since I am not in Malaysia. How much do I have to pay for lawyer fees and other related cost? Is there any table of calculation to be referred?

Chat Property Malaysia

AuthorHi Aini:

I do not have answer for you. The best ask you lawyer to breakdown the fees for you

Angie

Need your advice, I have a property which has 2 owners and would like to transfer half share of the property to another owner.

So how do I calculate the stamp duty?

Chat Property Malaysia

AuthorI trust Lawyer will have better advice on this as I personally no experience in this matter for now.

vijeendrean

I pay booking fee RM3300.house price 330000.so i mark up the price to 370000 and i get loan 85%.so how much spa and loan aggreement.

Chat Property Malaysia

AuthorIt has to be your mark up price

Irene

Hi

I purchased a unit from direct developer as follows:

1. Purchased price in booking form

Selling price RM 380,000.00

Discount RM 34,200.00

Nett Selling Price RM 345,800.00

2. SPA Price: RM 509,000.00

SPA Price after rebate: RM 297,600.00

3. Developer invoiced: RM 320,801.24.

Questions:

1. I was charge RM 11,200.00 from developer solicitors firm on application for FIC & State of Authority’s Approval. Is this payable by me?

2. There are difference 2 selling price between the booking form and SPA after rebate price. Which selling price should I pay the developer?

3. By law, if I only need to pay what is stared in SPA (After rebate selling price). Is there a possibility I request the Developer to refund me the excess payment (the amount between the booking form and the amount stated in SPA afterrebate selling price)?

Kindly help to adv.

Lost soul

Chat Property Malaysia

AuthorHi Irene:

For your case, it is based on what you have agreed with developer on the agreed priced.

The SPA is the legal document and all the charges by local authority will be based on the SPA priced.

It will not take into consideration of the rebate/discount by the developer.

Rebate/Discount are the mutual agreement with the developer and purchaser.

Hope your doubts are answer

Bryan

Hi, I bought a house of RM168,800.00 in 2003. I then refinance the property at RM245,000.00.

Fyi, the developer has wound up and the strata title has just out.

I received a letter from the liquidator to request a liquidator fee of sum RM3,180.00.

May I know why we need to pay for the fee and is this amount is high?

Also, other than this fee, what else fees I still need to pay and how much?

Chat Property Malaysia

AuthorHi Bryan:

Do check with your lawyer with regards to this matter.

powerful love spells

Hi,I log on to your blog named “How to calculate Legal Fees & Stamp Duty for my property purchased? | Property Malaysia” like every week.Your story-telling style is witty, keep it up! And you can look our website about powerful love spells.

Ky

Hi, brought my 1st house yr 2003 and developer wound up. Now, year 2018, liquiditor informed MOT able to proceed. So, stamp duty of MOT 2018 will be based on SPA price or market valau price?

If maket value, who determine the price?

Do I eligble for rebate/disbursement as a new house owner?

Thanks.

Chat Property Malaysia

AuthorHi KY:

I do not know this details. It is a good news for you as you can have your title now.YOu may check with your lawyer on your queries.