All of us know that for 99% of the people own their house through mortgage. Only 1% of the cash rich people buy with cash. Most of the youngsters are asking, how much can they borrow from bank?

There are no fix rule or actual formulae on how the bank calculate each of everyone loanability. However, there are two pre-requisites:

- CCRIS (Central Credit Reference Information System) is clear

- CTOS (Credit Tip-Off System) is clear

How to calculate or to determine how much bank will give me loan?

To gauge the maximum property price you can afford, it is always best to ensure that the total monthly installments of all your outstanding loans, and your prospective home loan do not exceed one-third (70%) of your net monthly salary. Net monthly salary refers to your salary after deducting income tax and EPF contributions.

If your monthly expenditure have exceeded the 70% of your monthly salary, then the bank rate you as over-commit financially. There is high possibility having difficulty making payments when there is emergencies or when the interest rate increases.rise.

Case Study 1:

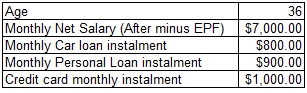

A young graduate, Jacky wanted to buy his first house after 2 years working as an IT analyst. He is prudent in his spending and do not have any personal loan. Jacky also pay his all outstanding credit card every month. Below is the financial details about him

Available net income after Commitment = $2500 – $500

= $2000

70% of the $2000 = $1400

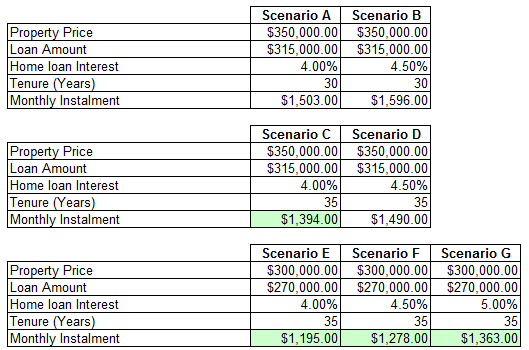

As such, the maximum monthly installment Jacky can commit on his housing loan is $1400 per month. Below is his option and choice of property price he can buy.

Based on the 7 Scenarios depicted above, Jacky can buy the property prices range $300K and $350K. From the above table, you may observed that the factors affecting the monthly installment based are:

- Interest rate

- Loan Tenure

Case Study 2:

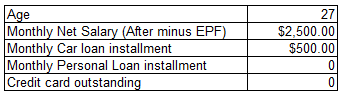

After 10 years working as banker, Sharon start to consider to purchased her own dream home. She is working in KL and she is aware of the escalating price for the past few years. She has taken personal loan and credit card installment , refer to below

Available net income after Commitment = $7000 – $2700

= $4300

70% of the $4300 = $3010

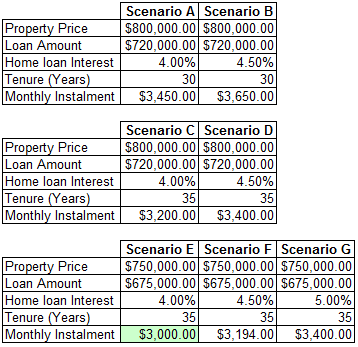

As such, the maximum monthly installment Sharon can commit on his housing loan is $3010 per month. Based on below calculations she can buy property priced below $750K.

A short video explains How does a bank work? Watch the easy illustrated explanation below:

A short video explains How does a bank work? Watch the easy illustrated explanation below: