Last week, a group of Six of my team make a several booking from the secondary market in Raja Uda, Butterworth area. After placing the deposit and signed the booking form, all of us are looking for bankers to proceed loan and get quotations for the legal fees. Basically there are two area of legal fees required to pay and Stamp Duty need to be factor in when you purchased your property.

Do take note that legal fees is paid on top of the property price you purchased. Legal fees is payable to the appointed lawyer who will prepare Sale & Purchase Agreement between purchaser and vendor. On other hand, Stamp Duty which also known as Memorandum Of Transfer (MOT) is payable to the government & collected by Lawyer on behalf of the government.

The 2 parts of Legal fees are:

- SPA legal fees

- Required to add in the stamp duty

- Loan Agreement fees

- Required to add in the stamp duty

How to calculate SPA legal fees?

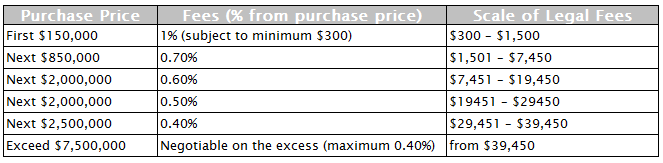

Lawyer fee for Sales and Purchase Agreement (calculated based on the SPA Property Price):

Example 1:

Purchased Price = $140,000

Legal fees = $140,000 x 1% = $1,400

Example 2:

Purchased Price = $350,000

Legal fees:

1st $150,000 = $150,000 x 1% = $1,500

2nd $200,000 = $200,000 x 0.7% = $1,400

Total = $1,500 + $1,400 = $2,900

How to calculate SPA Stamp Duty?

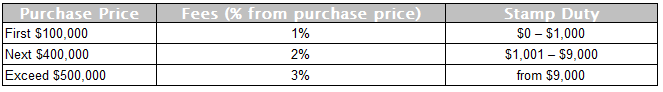

Stamp Duty of Sales and Purchase Agreement (calculated based on SPA property price):

Example 1:

Purchased Price = $140,000

Stamp Duty = $100,000 x 1% + $40,000 x 2% = $1,800

Example 2:

Purchased Price = $350,000

Stamp Duty = $100,000 x 1% + $40,000 x 2% = $6,000

With above calculations, there is miscellaneous fee for preparation of Sales and Purchase Agreement. This could be at least a few hundreds tobe add on. From 1st April 2015 there will additional 6% government tax on total lawyer fee for Sales and Purchase Agreement.

How to calculate loan agreement fees?

If you are buying with cash, you do not need to factor in this loan agreement fees. Lawyer fee for Loan Facility Agreement (calculated based on mortgaged amount). The legal fees scale is similar to the SPA legal fees scale.

Example 1:

Purchased Price = $140,000

Mortgage amount = $140,000 x 90% = $126,000

Legal fees = $1,260

Example 2:

Purchased Price = $350,000

Mortgage amount = $350,000 x 90% = $315,000

Legal fees = $2,655

How to calculate loan agreement Stamp Duty?

Stamp Duty of Loan Facility Agreement (calculated based on mortgaged amount) multiply by 0.5%

Example 1:

Purchased Price = $140,000

Mortgage amount = $140,000 x 90% = $126,000

Stamp Duty = $630

Example 2:

Purchased Price = $350,000

Mortgage amount = $350,000 x 90% = $315,000

Stamp Duty = $1,575

Summary of Legal Fees and Stamp Duty Cost

Disclaimer: ChatPropertyMalaysia.com has made every effort to ensure the accuracy and correctness of the calculations, contents, information or data contained in this section. However, ChatPropertyMalaysia.com do not represent or warrant the truth, accuracy, completeness and correctness of the same. ChatPropertyMalaysia.com accept no liability for loss or damage suffered or incurred by you or your estate as a result of your reliance on the material above or howsoever arising from the use of the information or material presented herein. This page is intended for educational and general awareness purposes only and should not amount to any form of advice.

24 comments