Very often, I got these questions:

“What is Greater Kuala Lumpur (Greater KL) all about”?

“How can I benefit from this plan, in term of investment and business opportunities”?

“Does Rawang under Greater KL”?

“Does Semenyih under Greater KL”?

“What about kLIA and Sepang area”?

“What about Nilai and Seremban”?

Definition of Greater Kuala Lumpur/Klang Valley

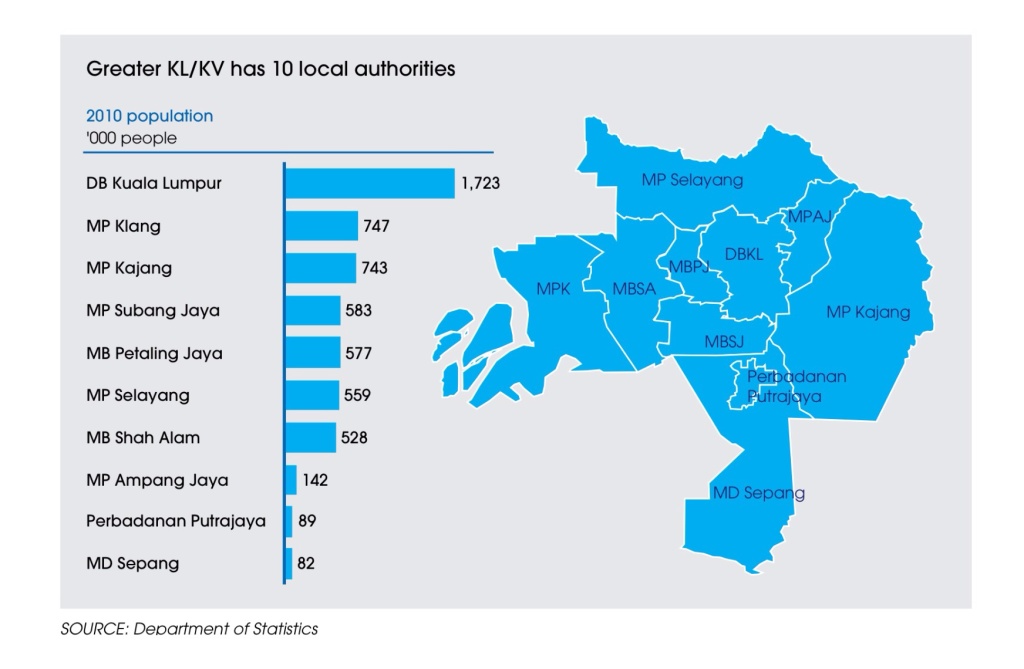

The definition of the Greater Kuala Lumpur/Klang Valley Region is taken from the Economic Transformation Programme (ETP) (Source: Pemandu, 2010).

Greater KL comprises Kuala Lumpur, Putrajaya and all districts in Selangor with the exception of Kuala Langat, Kuala Selangor, Sabak Bernam and Hulu Selangor.

For this National Key Economic Area (NKEA), Greater KL/KV extends beyond the boundaries of Kuala Lumpur.

It is defined as the area covered by 10 municipalities, each governed by local authorities, as illustrated below:

In 2010, the population of Greater KL/KV is approximately 6 million, and it contributes about RM263 billion to the nation’s GNI. This translates to 20 percent of the national population contributing 30 percent of the nation’s GNI, proving that Greater KL/KV is indeed the engine of the nation’s economic growth and hence designated as a NKEA.

Within the ETP, the NKEA (National Key Economic Area) for the Greater KL/Klang Valley Region has specified the following objectives:

‘To achieve a top-20 ranking in city economic growth while being among the global top-20 most liveable cities by 2020 via 9 entry point projects (EPP)’.

With the above, the following questions answered:

“Does Rawang under Greater KL”?

Yes, it is under MP Selayang

“Does Semenyih under Greater KL”?

Yes, it is under MP Kajang

“What about kLIA and Sepang area”?

Yes, it is under MD Sepang

“What about Nilai and Seremban”?

No, however in defining the region for the Master Plan, analysis of travel demand data indicates that areas such as Nilai and Seremban, whilst being outside the defined region, do contribute significant demands to Kuala Lumpur and should therefore be considered in developing the Land Public Transport strategy.

Nine entry point projects (EPPs) will be pivotal towards achieving our aspiration for Greater KL/KV – by 2020.

However, we will only discuss on 4 main projects that have the biggest impacts and related to property investment.

Greater KL/KV as a magnet (Job opportunities)

EPP 1: Attracting 100 of the world’s most dynamic firms within priority sectors.

EPP 2: Attracting the right mix of internal and external talent.

Greater KL/KV connect (Public transport connectivities)

EPP 3: Connecting to Singapore via a high speed rail system.

EPP 4: Building an integrated urban mass rapid transit system.

EPP 1: Attracting 100 of the world’s most dynamic firms within priority sectors

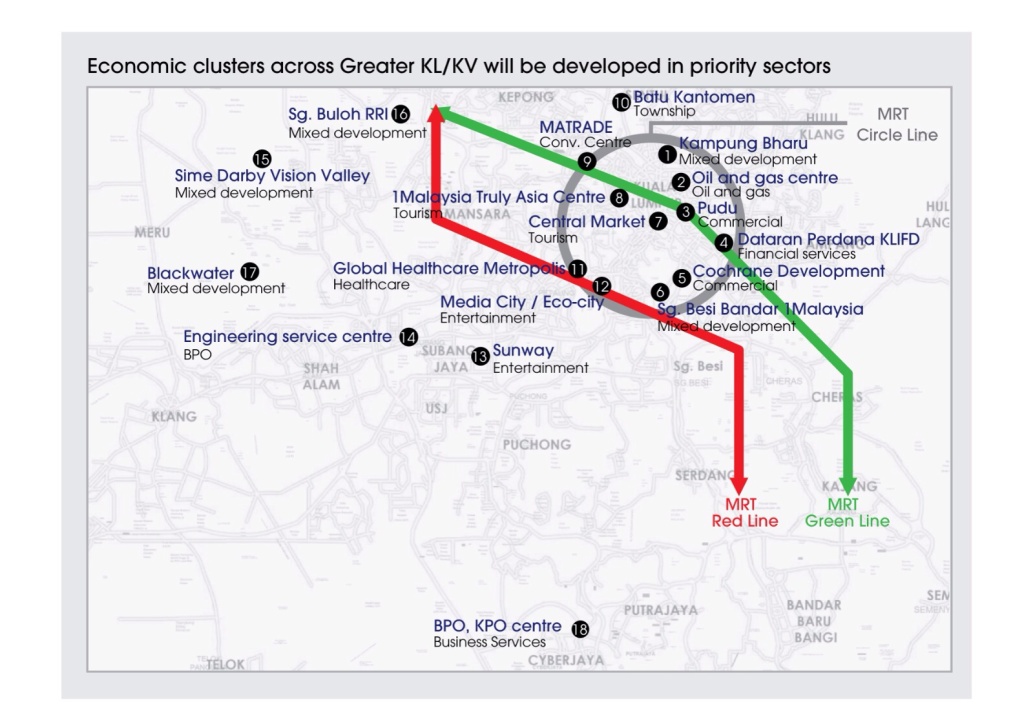

Greater KL/KV’s value proposition is clear: a strong talent base with high English proficiency, a strategic location at the heart of fast-growing Asia, superior infrastructure, a lower cost of living compared to competitor cities such as Singapore and Hong Kong, and a liveable environment.

Towards this end, we seek to attract the world’s leading and most dynamic firms to locate their headquarters in the city, especially MNCs relevant to the priority sectors for Greater KL/KV. Attracting 100 such firms will contribute in the order of RM40 billion in annual GNI to Greater KL/KV.

Spatially, the firms and economic activities will be focused in economic clusters across the landscape of Greater KL/KV as shown in photo below. These clusters will be serviced with world-class amenities and connectivity. These economic clusters form part of the enhanced proposition to target companies.

The priority economic sectors for Greater KL/KV were identified based on current and potential contribution to GNI and include financial services, business services, education, tourism and retail. In 2009, these five sectors combined contributed 41 percent to Greater KL/KV’s total GNI.

Impacts on property: Job opportunities resulted in influx of population to Greater KL, hence create higher demand for the needs of properties, whether they will buy it or rent first.

Increase demand for: mass market properties and medium cost properties.

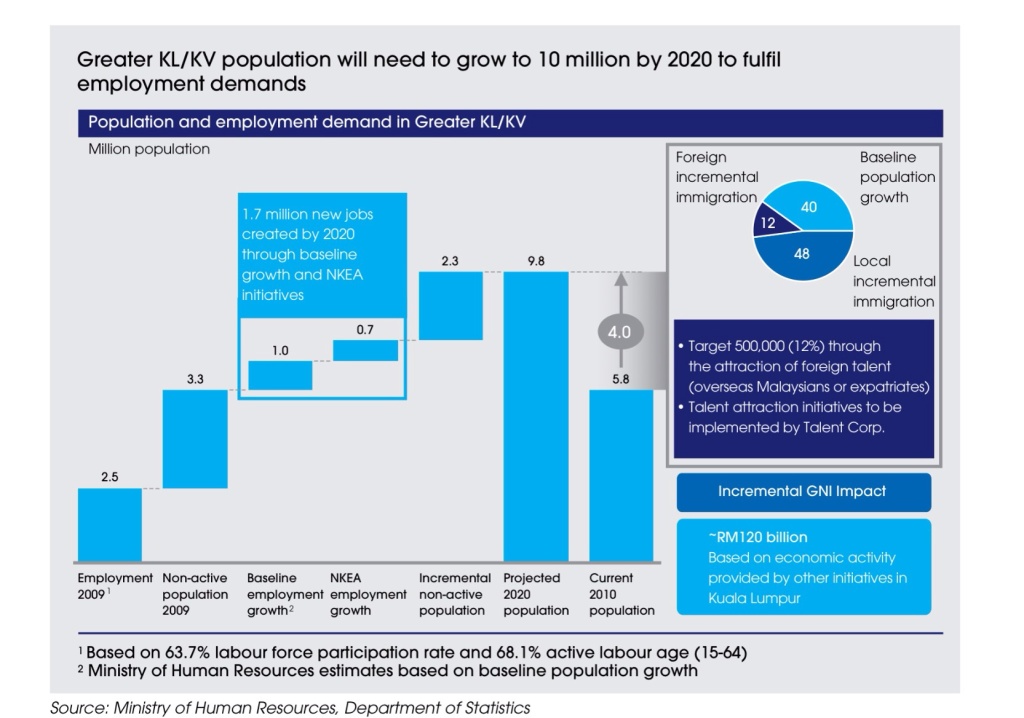

EPP 2: Attracting the right mix of internal and external talent.

To fulfil employment demand, Greater KL/KV’s population will need to grow from 6 million in 2010 to 10 million by 2020, representing a significant increase in the pace of growth of 5.6 percent per year compared to current baseline estimates ranging between 1.9 to 2.9 percent. This step-change in growth is ambitious, but not unprecedented.

For example, over the period of 1999 to 2009, Shenzhen grew at an average rate of 7.1 percent per year. The incremental 4 million people in Greater KL/KV comprise both baseline population growth of 1.6 million people with the remaining from both domestic and international immigration.

Of the 2.5 million immigrants expected to relocate to Greater KL/KV, 20 percent is expected to come from abroad, both expatriates as well as the overseas Malaysian community (the Malaysian diaspora).

Impacts on property: the relocation of expatriates to Greater KL create higher demands for rental market, especially high end and luxury properties.

Increase demand for: rental properties in KL CBD

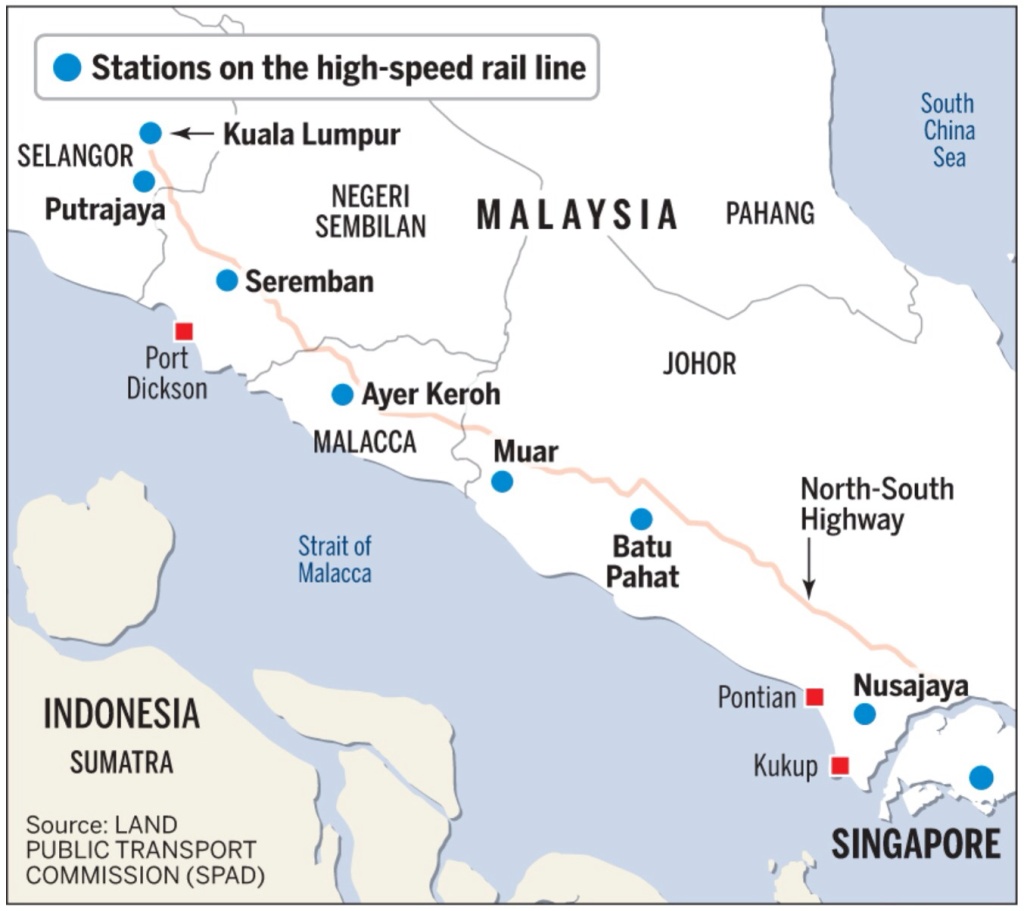

EPP 3: Connecting to Singapore via a High Speed Rail System

The high-speed rail (HSR) project connecting Singapore and Kuala Lumpur will have seven stops in Malaysia, namely Bandar Malaysia @ Kuala Lumpur, Putrajaya, Seremban, Ayer Keroh, Muar, Batu Pahat and Nusajaya.

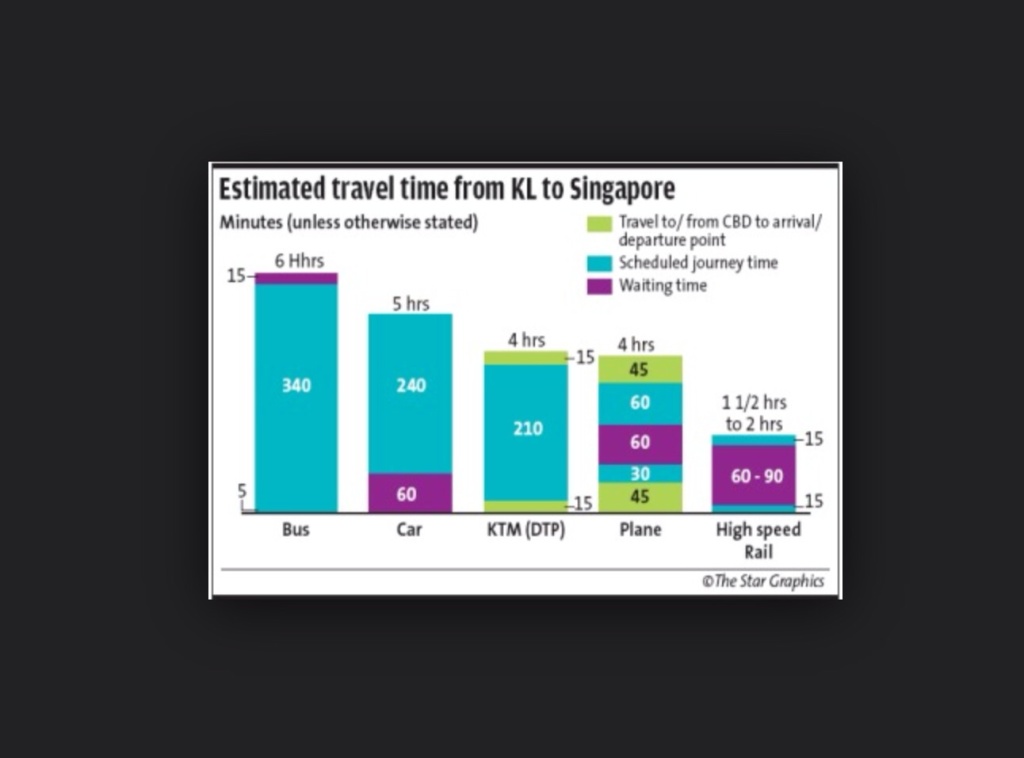

The HSR service will essentially transform travel on the Greater KL/KV–Singapore route by making daily travel a viable alternative. Door-to-door travel time will take just 1.5 to 2 hours, putting this route into the category of daily travel. This represents a savings of over two hours over air travel, the fastest available mode today.

Building of the high-speed link could begin in Q3 2015: KL transport official

Impacts on property: the shorter traveling time will translate to virtually shorter distance between Malaysia and Singapore. This will narrow down the property price difference between Singapore and KL, which means KL properties price will increase gradually and try to match Singapore property price.

EPP 4: Building an Integrated Urban Mass Rapid Transit System

Moving forward, Greater KL/KV’s aspiration to achieve a 50 percent public transport modal share by 2020 will need to be supported by increase in coverage and capacity of urban rail.

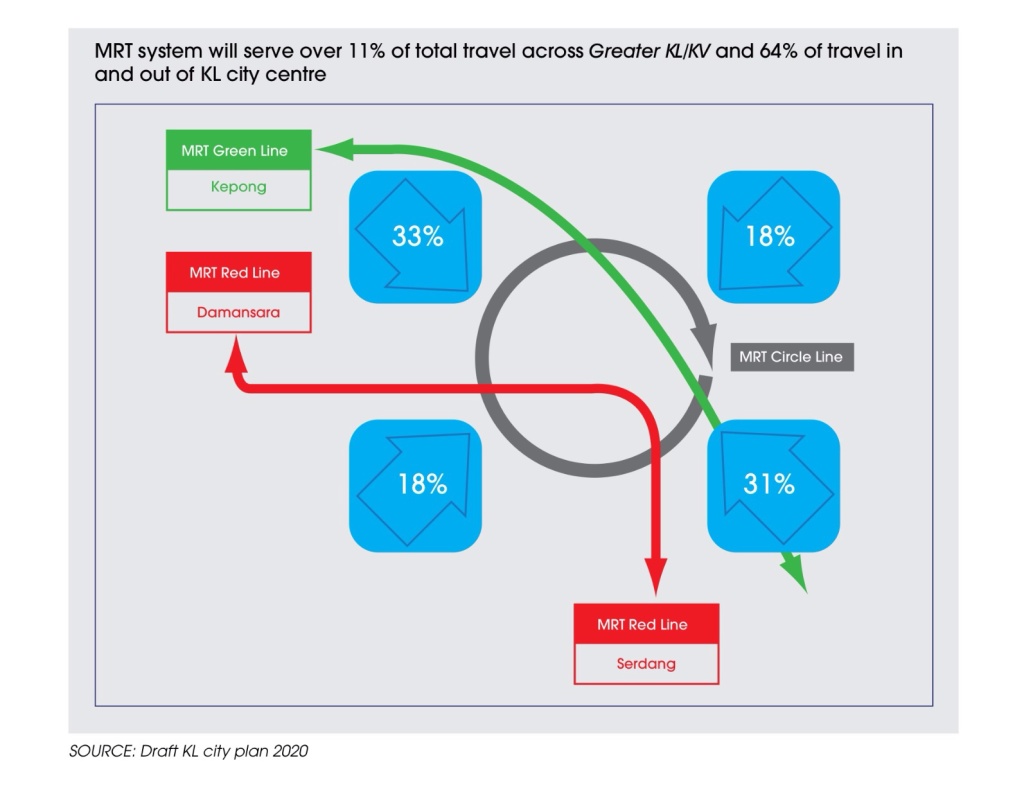

The proposed MRT system for Greater KL/ KV will span 141 kilometres with three major routes serving a radius of 20 kilometres of the city centre. The system is estimated to be able to carry up to 2 million riders by 2020, serving 11 percent of total trips within Greater KL/KV and 64 percent of travel in and out of the KL city centre.

Impact on property: with increase of petrol price and removal of subsidize, travelling with private car will getting more costly in future. MRT/LRT/BRT/Monorail/KTM will be the preferred choice to commute between home and workplace. Look at Singapore, Hong Kong or Taiwan as example.

Increase demand for: any properties near to any public transport station, especially MRT/LRT/BRT/Monorail. However, residential properties too near to these station will possible experience negative impacts. Commercial properties expected to benefit from it.

Read the LRT Extention line story.

1 comment