Very often that people will asked me, what is my BEST property i had purchased so far?

In that moment, I cannot answer spontaneeously because I did not come across this question at the first place.

I think back about this simple question, what does it means?

It can mean that the best property, the cheapest property, or the most beautiful property, it highest rental yield and many angle of it. From investor point of view, I will say is the property that have Loan to Value ratio the lowest, it will be the best property.

What is Loan To Value Ratio?

Very simple, let’s assume your total mortgage loans outstanding today is RM 300K, and the current market value of your Property is RM 600K.

Hence, your Loan to Value ratio = Loans outstanding / Market Value of Property

= 300K/600K x 100%

= 50%

If the property is a paid of property, then you have an 0% LTV for the property, this will be the BEST!

How to get the Best Loan To Value Ratio?

I trust that a lot of property investor owned a lot of property that has 50% LTV on hand. For the newbie, will ask, how to get the lowest LTV now? What will be the strategy?

From my humble opinion, there is only two strategy available.

Strategy 1:

Very simple strategy which is: Start to take action and invest in property NOW!. If you are procrastinating, you’re not alone.

You may ask, wouldn’t it be better to wait to invest until proeprty prices are lower? If it was easy to time the property market, then all of us are millionaires now. No more poor people.

Let me share with you, in 2010, the property market is HOT and on the rise. A lot of my circle of friends telling me that wait for the price to come down and only buy.

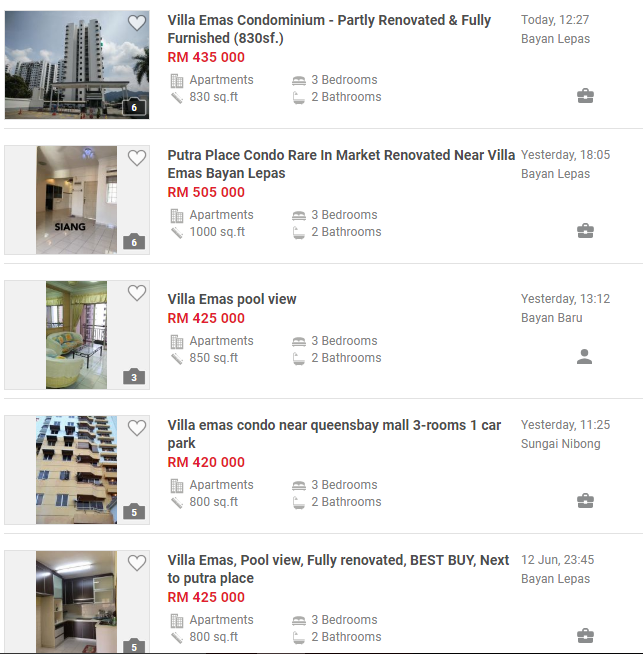

If I listen to them, till today, I will not owned any rental properties. In year 2010 Nov, I bought into Villa Emas in Penang. The market asking price is RM260K and above for a 3 room condominium with 850 sqft.

There is very little chance to buy at lower than this price. Guess what is the price I bought into at that time after two weeks of searching and viewing?

In fact, I bought it at slighly overpriced at RM285k for 2 carparks. Now you may do your calculations for the LTV now even I bought it at high priced.

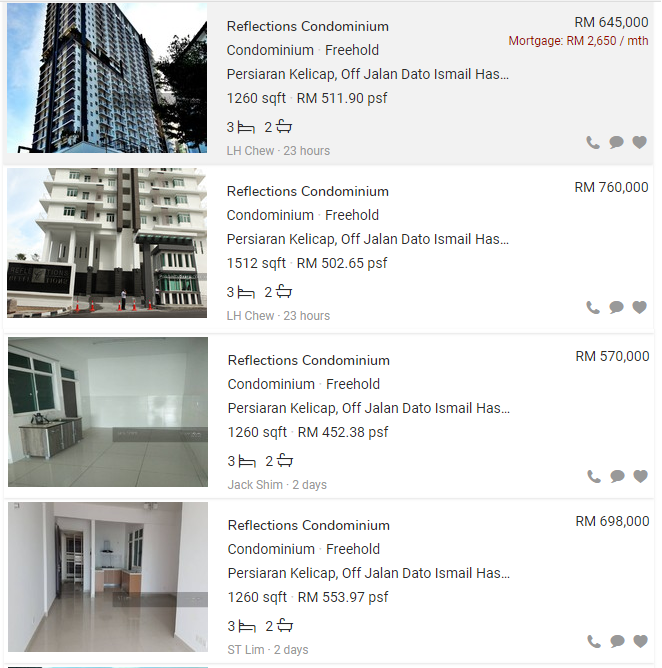

Similarly, when SP Setia launch their first Condominium in Bayan Lepas Penang, I also bought at the developer priced at RM440K for 1250 sqft.This is premium priced to paid for a simple 3 room condominium at Bayan Lepas area. You may google search what is the price for now.

Take advantage of one of your greatest assets: time.

Strategy 2:Find from sub-sale market with Below Market Price at least 30%

Finding a property with below market value of 30% can be easier said than done. However, the opportunity is out there for us to find.If you do not work hard to find it, others will.

So why let the opportunity slip thorugh?

With above either Strategy 1 or Strategy 2, you could apply and take advantage of it.