I received above images through a whatapps group. EVERYONE, including me 14 years ago, has been complaining about the ever increasing cost of living upon returning from Singapore. Everything seem to be expensive compare to Singapore back then. I also want to buy a house and keep looking for it due to affordability. Salary increment cannot cope up with the increased house price. Do anyone ever understand why?

Will house prices continue to rise forever?

The answer is a big YES. House prices are high, and many expect them to continue rising. The main reason behind of the rising property prices due to the inflation. With inflation in placed, there is no way the property price will come down.

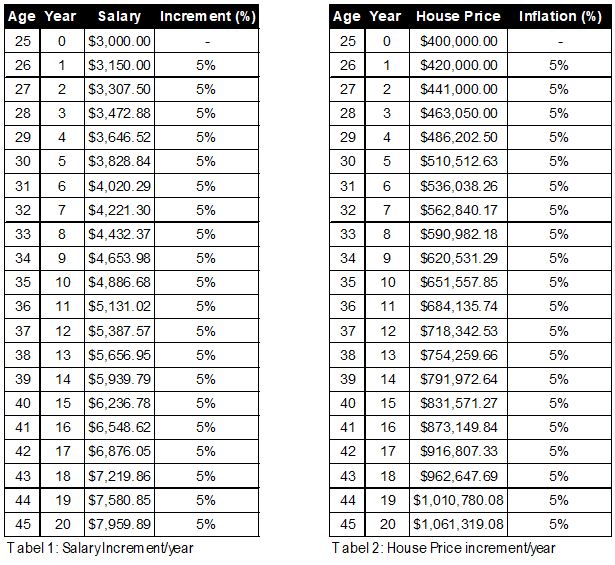

Now back to the questions why the Salary increment cannot cope up with the increased house price? Let’s say the annual increment is 5% (this is industrial standard) and the inflation rate yearly also 5%, but why still not able to cope? Now, let’s look at the table below:

Table 1 show that a young graduate get is first employment at the age of 25 years old with starting salary at RM3000. At the same year, a nominal house price is at RM400,000.

Assuming his performance is good and above average, the yearly increment is 5% for the next 20 years. At the age of 45, his salary is RM7960 per month. His salary has increased from RM3000 a month to RM7960 a month, the growth is 165% (RM4960).

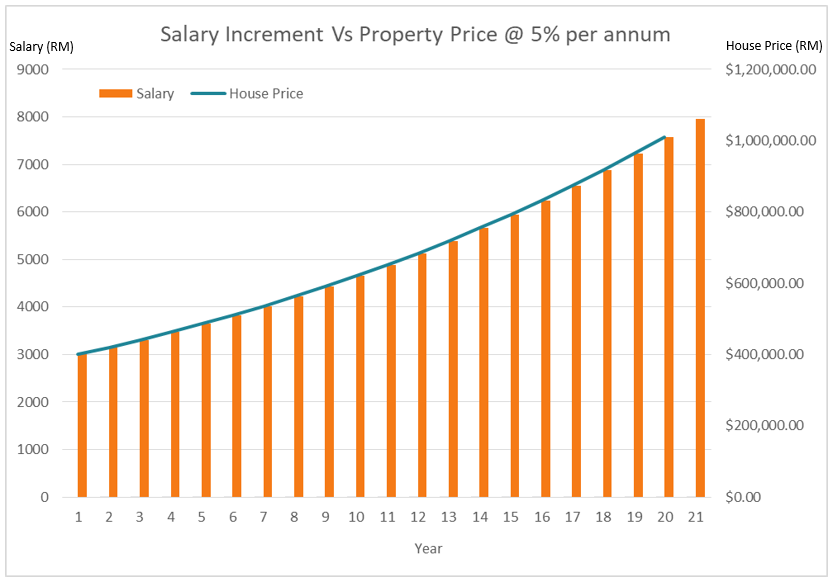

What happen to the house price for the same period (20 years) with similar 5% inflation per year? The house price has grown from RM400,000 to RM1.06 million. The growth rate is the same at 165% (RM661,319). The chart below will paint the picture clearer.

Both salary and house price grow at the same rate which is 5% per annum. But the salary only increased RM4,960 compare to RM661,319.

So now, do you aware what is happening above now, if you are just working as an employee and do not invest in any property, you will not able to catch up already. The property price hike faster than your salary increment due to at different quantum.

So what are you waiting for? Make your money work harder for you!