I was admiring to all my friends that they can invest in commercial property. Anyway, they have experience in property investment more than 5 years! As a newbie or virgin, how can I reach to their level in investment into commercial property? I did ask this question to many of successful investors and their advice are almost same, which is start from the beginning of residential property. Majority of them said they did also start from residential property investment.

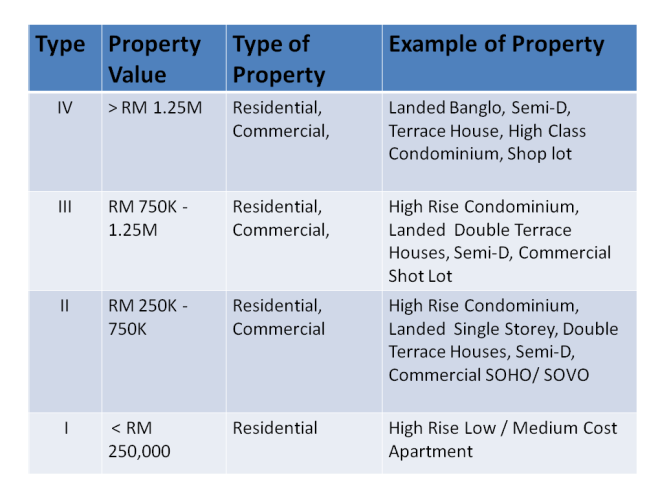

Base on the current market value, I summary the type of the property into 4 types with property value range as table below. This will be the target budget for investment journey.

Type I: Property value less than RM 250,000

This type of category normally is residential property type. Example, high rise low or medium cost apartment.

For this type, a person need min gross income RM 2000-2100 per month in order to get the bank loan approval for purchase this type of property. Please check Affordablility of Loan or How much you worth to get loan from bank? for more details.

As newbie or virgin in property investment, it will be better to invest in this type of budget property. Normally, the rental yield is good in this type of property, look out for the GEM!

Type II: Property value around RM 250,000 – RM 750,000

This type 2 can be residential or commercial property category and it can be high rise or landed type. Example, high rise condominium, landed single storey house, double terrace house, semi-D, commercial SOHO, SOVO and etc.

For this type, a person need min gross income RM 2200-6500 per month in order to get the bank loan approval for purchase this type of property.

As newbie or virgin in property investment, if your salary range is as above, you can invest in this type of budget property too.

Type III: Property value around RM 750,000 – RM 1,250,000

This type 3 can be residential or commercial property category and it can be high rise or landed type too. Example, high rise condominium, landed double terrace house, semi-D, commercial shot lot and etc.

For this type, a person need min gross income RM 6500-10,000 per month in order to get the bank loan approval for purchase this type of property.

This budget of property will be the next level of investment which I category it as 3rd type/ 3rd level.

Type IV: Property value above RM 1,250,000

This type 4 can be residential or commercial property category and it can be high rise or landed type too. Example, high rise condominium, landed semi-D, landed banglo, commercial shot lot and etc.

For this type, a person need min gross income above RM 10,000 per month in order to get the bank loan approval for purchase this type of property.

This budget of property will be the highest level of investment which I category it as 4th type/ 4th level.

With the summary type of property, hope it can help you knowing more clearer about your budget in property investment!

How you plan your journey in property investment? Do comment at below and share us more…

shansivita

can i buy a house for my salary rm 2100, my phone number012-4444824