Few years back, before I step into the property investment journey, I admired those people who are able to have few houses. At that time, I do not understand how could bank approved their home loans again and again.

When I started in the property investment journey, first few home loans, there is no issue, the process can be very smooth. But after 3rd year, my home loan application getting tougher and tougher. Banks ask for more documents for my income and ask more question on my purchases. I am a good paymaster for all my monthly home loan instalment, always pay in full for my credit card bills, no bounced cheque, clear CCRIS etc.

One for the banker said that my risk is high due to too many commitment. Saying that all my commitments are all in the properties. Then I started to analyze and ask banker what are the key factor banker looking at. The replies is “Debt Service Ratio”. In order to get your home loans approved again and again, I need to get the Debt Service Ratio as low as possible. Some bank requires the DSR not more than 70%, some is 60%. So my guideline is DSR not to exceed 0.6, the chance to get your home loans approved is almost 100%.

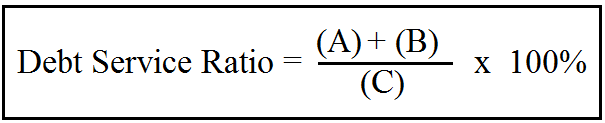

What is Debt Service Ratio?

Bank looking at your DSR, by knowing the ratio of your debt to income is important and key in getting your loan approved. There is formula used by banks to evaluate your affordability level.

(A) Sum of your total commitment = Total loan on mortgages, car loans, personal loans, your minimum monthly payments on any credit card debt, and any other loans that you might have

(B) Current New Application

(C) Sum of your NETT income = net income after the deduction of income tax / KWSP/ SOSCO + All Part time earning + Freelance Income etc

Majority of the home loan rejection is due to the DSR is over 70%. Not all the bank having the similar cut off or capping of DSR, some is 60%, some is 70%.

How to get unlimited home loans?

Now, back to the first question and analyze the DSR formulae again. The only way to reduced your DSR is to increase your net income. You have to declare all your other earning such as rental income, part time income working as freelance service to the maximum to the bank. Once you have maximize your earning, then the bank will be more comfortable that you are able to pay the monthly instalment as required.

So the key is to maximize your earning capabilities.

Equitorial Finance

Do You Need urgent financial credit loans?

* Very fast and quick transfer to your bank account

* Repayment starts eight months after you get the money

in your bank account

* Low interest rate of 2%

* Repayment of long-term (1-30 years) Length

* Conditions of flexible loan and monthly payments

* Apply–Get Approval–Account credited with Loan amount

REQUEST FOR LOAN

================================

Name : ……………….

Second name : ………………

Contact Address : ……………..

Country : ……………….

Age : ……………………..

Sex : ………………..

Phone Number : …………..

Status: ……………..

Occupation : ……………

position : ……………..

monthly income : …………..

Loan Amount : ……………..

Purpose for Loan: ……………

duration : ………………..

Have you applied for loan before : …………

you understand English : ……….

kindly fill and send the form to:

Email equitorial.finance1@outlook.com

Your Sincerely ,

Suet Nathan

C.E.O Equitorial Finance.

Larry

Do you need a loan for 2% Interest Rate? If yes Apply with Full Name,Loan Amount,Duration and Phone# at via email: michaelprantl11@gmail.com

Mr. Michael Prantl.

Do you need a loan for 2% Interest Rate? If yes Apply with Full Name,Loan Amount,Duration and Phone# at via email: michaelprantl11@gmail.com