When some one want to buy their first house for own stay or as investment, the first question is how much is the initial cash outlay? It just simply means that how much money do we need to fork out do own the house?

One day, you kind landlord seeing you as a good paymaster, he may offer you to buy over his house which is below $50,000 from the market value. If you do not know how much you have to fork out even if the best deal is in front of your eye. Of course many of us do not want to over commit as well. Below all the calculations are just an estimation numbers, it could have 5% varies from time to time. Nevertheless it should be a good guide and understand well on your current financial situation.

What are the good deals observed recently?

In the past 3 weeks, there are several good deals from the group. One is the Widuri Apartment, which 7 team members able to purchased 20% below market value. Second deal is awesome. It is called The Ideal CEO which is about 40% below market value. This awesome deal grab by one of the hard working girl and she is well verse on the way of how to look for the below market value properties. Whatever the reason behind why the seller is selling at such low value, will not be explore here at the moment. As such, when such deal come across, the first thing in our mind is, how much money do we need to fork out in the initial phase?

Will bank going to give me loan?

First thing need to check is your loan ability. Are you able to get loan from the bank or not. There is a previous post on this subject “How much I can loan from Bank for my house?”

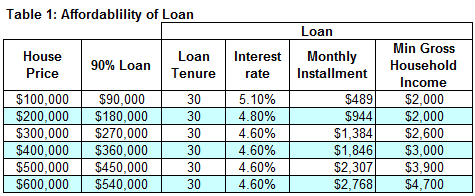

Table 1 below is a rough guide on the minimum gross household income for each loan category

What other fees incurred when purchased property?

Once you had secured your unit, now you need to calculate the cost will be involved. Typically the cost involve will be as below:

- Agent fee

- Sales and Purchased legal fee

- Loan documentation legal fee

- Renovation Cost

Agent fee

If the deal is recommended the agent, it is quite standard that we need to pay for their services. The fees is very depending on the area. For example, in Penang, the agent fees for the buyer will be 1% of the purchased price, whilst in Kuala Lumpur, there is no agent fees involve for the buy portion. As such, you will need to check this during your first viewing with you agent.

Sales and Purchased, Loan documentation legal fee

The details of how to calculate the legal fees is written at “How to calculate Legal Fees & Stamp Duty for my property purchased?”

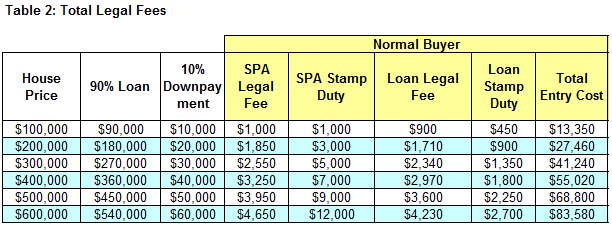

Table 2 below is summary of the Total Legal Fees involved

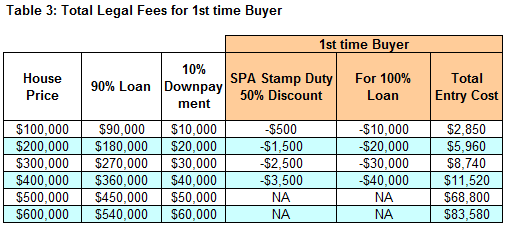

If you are a first time buyer, there are 2 incentives as below:

50% Stamp Duty Discount on Sale and Purchase Agreement for properties up to RM400,000

Skim Rumah Pertamaku, which allows you to take a 100% loan for properties up to RM400,000

Table 3 depicted the incentives given

Renovation cost

The final cost to consider will be renovation cost. In fact this cost is not required during initial stage. It is at the later stage when the overall transaction completed and key hand over to you. As such renovation is needed or not very dependable on each individual. The renovation items also can be varies as well. Since this is subjective and there is no clear and fix rules on renovation cost, it will be left out when to sum up the total initial cash outlay.

What will be my final initial cash outlay when buying my house?

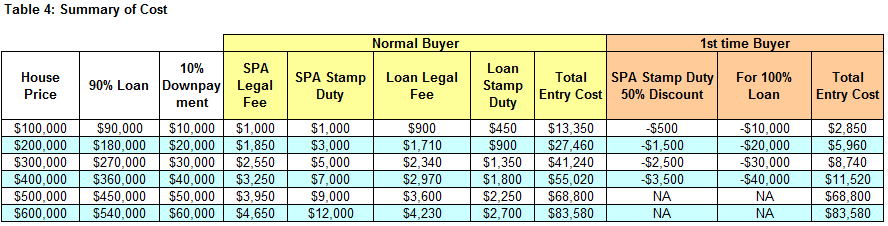

With details discussion above, Table 4 is the summary of each cost for normal buyer and first time house buyer. It is exclude the agent fees and renovation cost.