Last weekend,my family and I spent a short getaway at Park Royal Hotel at Batu Feringhi. After check out on Sunday, we head to Gurney Plaza for shopping.

We we reached at Gurney Plaza, is time for us to feed our tummy after having some sport activities at Park Royal. We went to search for food at the lower ground floor and spotted a new restaurant called “Fresh Bite” Asian cuisine.![IMG_20150329_130717[1]](https://www.chatpropertymalaysia.com/wp-content/uploads/2015/03/IMG_20150329_1307171-168x300.jpg)

In the past, I almost bought the shopping mall lot at Queensbay mall. Currently most of us love to do shopping in the shopping mall rather spending time in the one shop only. The main objective of this article is to guide on how to justify if a shopping mall shoplot is worth to invest?

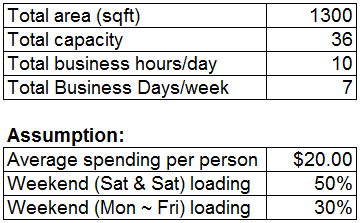

I am using the restaurant as an example for below calculations.

The restaurant maximum capacity is 36 seats. The restaurant operating hours is from 10am til 9pm. There are 3 servers in the front and 2 chefs at the kitchen. Average spending for a person estimate to be $20.00.

Estimate the average weekdays capacity is 30% per hours whilst in the weekend increased to 50% per hours. Below is the calculations.

Total weekly revenue=(2 x Total Capacity x Total Business hours/day x weekend loading x Ave Spending /person) + (5 x Total Capacity x Total Business hours/day x weekday loading x Ave Spending /person)

= $18,000

Total monthly revenue= $72,000

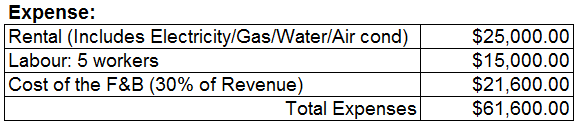

Then we have to calculate the expenses. I talked to the boss, he is kind enough to share with me that the total rental is $25,000 per month. It includes the utilities such as air conditions, electricity,gas and water. I assumed the 5 workers will take home pay at $3,000 per month. The cost of the food and drinks estimated to be 30% of the revenue.

Total Profit = Total Revenue – Total Expenses

= $72,000 – $61,000

= $10,400

Assuming that the rental yield is 6% for this unit, what is the market value for this 1300 sqft of shoplot?

GOSH, this unit is worth $5 million!

Every $1,000 raised in rental, the property price will increased $200,000!