In the previous post ” Where to get my capital for my first property? ” I mentioned we can withdraw EPF money for our down payment. Do you aware that we can use second options which is to pay our monthly mortgage? With this facility, it will definitely help our cash flow.

When i want to buy my investment property, I no longer able to withdraw EPF money for my second property down payment. I can do that provided I produced the proof to EPF office that I sold my first property, then I can withdraw again. However, the first property is my current home sweet home.

Again, I am relief that EPF had this scheme called “Housing Loan Monthly Installment Withdrawal”.

How EPF money can improve cash flow?

Through “Housing Loan Monthly Installment Withdrawal” scheme, it means that you can use your EPF money from Account 2 to pay your monthly installment. For example, if your monthly installment is $600 per month, you can withdraw $600 per month from your EPF account 2. Doesn’t this lessen your burden for your monthly installment to the bank? It surely will lessen a huge amount of financial pressure off your shoulder.

Housing Loan Monthly Installment Withdrawal Steps

- Ensure your Account 2 has at least $600 in balanced

- Go to your bank and request a letter for “Loan Balance Statement”

- Normally bank mortgage officer know what do you mean when you request “Loan Balance Statement” for EPF withdrawal application

- Bank will need 3 working day to prepare for you

- Bank will charged $10 for the documentation

- Once you collect the letter, just head to the EPF office and submit your application

- Made a photocopy of the Sales and Agreement after stamped by Lawyer

- Once submitted, you will wait probably within 5 working days

- The money will be credited to your specified bank account directly every month

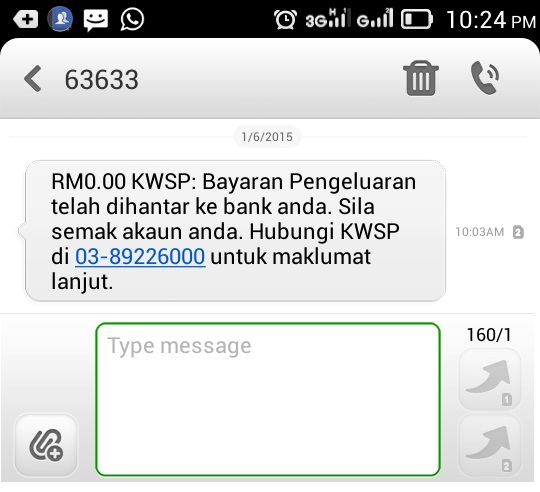

- SMS will be send to your phone as well when the money is bank in every month

Below is the sample SMS sent by EPF once the money is bank into account.

I love to received this SMS, if it comes with Kaching Kaching sound, it will be more exciting. Each application, you can specified the duration of the withdrawal. For example, if your monthly installment is $600 per month. Your account 2 has balanced of $15 000.

Yearly installment = $600 x 12 = $7 200

If for 2 years, total installment will be $ 14 400.

Since your Account 2 has $15 000, then you can either choose to withdraw for 12 months or 24 months. For instance, if you choose to withdraw for 24 months, once it is at up till 24 months, you can re-apply again by going through Step 1 till Step 8 again.

What if my account 2 has lower balanced?

If your EPF account 2 only has $5000, it does not matter. EPF will still give you the monthly installment by using below calculations:

Monthly installment by EPF = $5000 / 12 = $416.67 to your account

Again, bear in mind that you have to make good use of this money and ensure you will have 6% yield.

Tan Suan Lee

Is second house housing loan ( without disposing the first house) eligible for this Housing Loan Monthly Installment Withdrawal?

Chat Property Malaysia

AuthorHi Tan:

If your 1st house is withdrawal of Lump Sum and 2nd house is for monthly installment, then is still eligible.