During this COVIT-19 pandemic outbreak, I learn a new term which is “Moratorium”. When Bank Negara Malaysia (BNM) announcing this measures to help bank customers facing financial issues because of Covid-19, I was wondering what does it means? I did not know this is a term from finance. I never heard of this term for my life. It could be never happen in Malaysia or I was no need to worried about the financial when I was young.

I google it and simple explanation is “a legal authorization to debtors to postpone payment”, this will enables Malaysians to face the financial hardships during the COVIT-19 Movement Control Order (MCO) as a lot of business has to stop and not able to operates.

What does this Moratorium means for us? Below are the list available for reading if need more details.

Below will be high level of the table comparison from Uni Suites.

In this article, I focus only on the housing loan calculations as it will be impacting the majority for house owners.

For example, if your one month instalment is RM2,500, interest charged is RM1,700 and principal is RM800. Thus by taking 6 months moratorium, your potential 6 months cash flow saving will be as below:

Original instalment pay is RM2,500 x 6 months =RM15,000.

That means you will be having RM15,000 enable you to used as emergency fund if situation needed.

Plus you pay higher interest cause your principal did not reduce by RM800 per months during that 6 months .

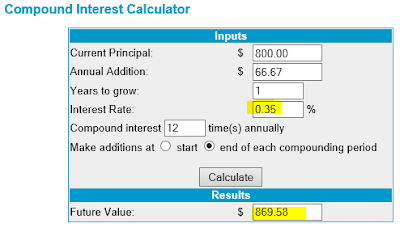

Assume your interest rate is effectively 4.2%, calculation as follow:

Compounded 6 months interest will be around RM58.95 (rough estimation). I am not financial advisor and I just calculate based on manual compounded way.

Impact to your cash flow is you have extra RM2,500*6=RM15,000 and your cost is RM58.95 extra interest.

If I go to the website and key in relevant figure, the total compounded will be around RM69.58

http://moneychimp.com/calculator/compound_interest_calculator.htm

The key message here want to deliver is that the borrowing cost is so low and personally, I will take this approach for the next 6 months.

Imagine if you have 3 rental properties and tenants ask you to have free rentals, what will you do if you do not take up this moratorium from the banks? Will you able to survive for the next 6 months cash flow if there I no rental coming in? RM15,000 x 3 properties = RM45,000

It will be a huge amount, isn’t it?

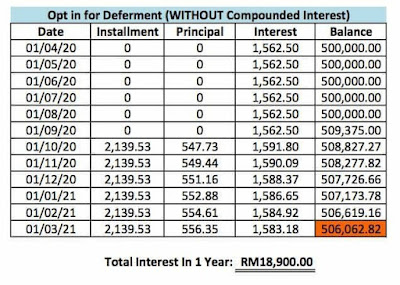

Another calculations to share as below:

Bear in mind that the moratorium on debt servicing payments will enable borrowers to have additional disposable income to spend or SAVE. The keyword is SAVE and invest into higher return opportunity during this down turn. Even if I can afford to continue servicing the loans, I will still take advantage of the moratorium to generate extra income by channeling to investments that produce higher returns than the debt servicing cost.

Given the low interest rates in servicing housing loans, the loan payments could give higher returns when invested in stock market since it is heavily hammered down now. Of course in depth due diligent requires to be done before putting your money into it.

Now, the decision is rely on you on whether to take up the moratorium by Bank or not. As mentioned, I don’t know how the pandemic is going to progress and how long it will takes, I will take up this moratorium offer to ease the cash flow and take opportunity to invest in the depressed stock market.