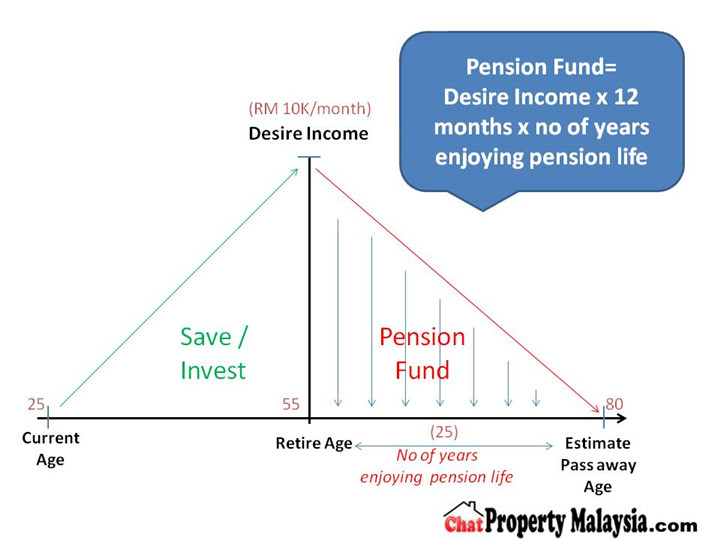

Do you dream to have a stable and enjoyable lifestyle after retire. When retire, we will not have working income but we need to spend for our daily expenses. Therefore, pension fund is important. Do you plan your pension fund? What is the amount of your pension fund?

For example case above,

Current Age = 25 years

Retire Age = 55 years

Estimate Pass Away Age = 80 years

No of years enjoying pension life= 80-55=25 years

Desire Income (to be able to cover your daily expenses and desire lifestyle)= RM 10, 000 per month

Pension Fund = RM 10,000 x 12 months x 25 years = RM 3,000,000

Will you getting shock of the pension fund? RM3 million if as example above. It is achievable? If answer is yes, then how? Let’s read through below for more analysis.

How to plan pension fund?

Here I will list down some study cases how to plan the pension fund and let’s analysis together.

1). Fixed Deposit (FD) Saving

If I choose FD saving to plan the pension fund and with compound interest calculation as below:-

Where,

- A = Final Amount that will be received

- P = Principal Amount (initial investment eg. RM 10,000)

- r = Annual nominal interest rate ( eg. if interest is paid at 4% pa, then it will be 0.04)

- n = number of times the interest is compounded per year (eg: for monthly compounding = 12)

- t = number of years (eg: 30 years)

Thus, the above formula values will be P = RM 10,000, r = 0.04, n = 12, and t = 30. So, the final amount that will be receive after 30 years is RM 33,134.98 (maturity value) with interest earned RM 23,134.98. Do you still think that this FD saving can help you to get your pension fund? I think majority will not because the reasons below:-

a). Number of years is too long but with only little interest earned.

b). Very difficult to save RM 10,000 as principal for those who start working at early age eg. 25 years.

c). The interest rate might be below 4% pa and base on that period of time interest rate.

2). Stock Investment

As example case above of the pension fund, the desire income is RM 10,000 per month, then a year total amount will be RM 120,000. If I choose stock investment and base on 6% stock dividends, I must have amount RM 2,000,000 to buy the stock.

To accumulate the investment fund above and if I wish to reach the target amount in 10 years.

RM 2,000,000/10 years= RM 200,000 per years

RM 200,000/ 12 months = RM 16,666.67

Thus, every month, I need to save up RM 16,666.67 continuously for 10 years to invest in stock then only I can achieve my target/ desire income. Do you think this is a big number? Will you start to think is it possible? I might feel that this is not a good strategy because the reasons below:-

a). The target is too far

b). The time frame is too short.

Tips from majority expert investors that I learned is never start with any <<psychological surrender>> investment plan.When you feel doubt about it, your inner heart will give up the target plan and you will not have incentive to move on.

3). Property Investment

Base on the same stock dividends, 6% rental yield for property investment. And as example case above of the pension fund, the target rental (desire income) RM 10,000 per month, then a year total amount will be RM 120,000. If I choose property investment, base on 6% rental yield, I must have amount RM 2,000,000 to invest.

Same as stock investment, I need amount RM2,000,000 to invest in property but the different is I may not need cash out RM2,000,000 to buy a property because I can leverage bank loan. Example, if I base on 70% loan to buy the a property value RM2,000,000 and I only need to cash out 30% down payment plus the additional 5% legal & stamp duty (as example others cost with total 5%). If I have amount of 35%, I can achieve my pension fund/ desire income as example:-

RM 2,000,000 x 35% = RM 700,000

RM 700,000 / 10 years = RM 70,000

RM 70,000 / 12 months = RM 5833.34

As comparison : monthly stock investment amount required is RM 16,666.67 vs. monthly property investment is RM 5833.34. Which do you think is more reasonable to achieve the desire income for your pension fund?

Anyway, any investment will have the risk either property investment or stock investment. We may need to learn how to plan and manage it. Hope everyone have a new perspective to look into property investment and let’s plan your pension fund now!