Jimmy: I have $400,000 on my saving now,I would like to invest into rental properties. I already sourced 5 properties worth $80,000 each. Should I buy with cash or apply for bank loan?

In term of calculating return from property investment, there are few types of return:

- Rental Yield

- Cash on cash return

- Net operating income

- Capitalization rate

- Payback or Return of Investment

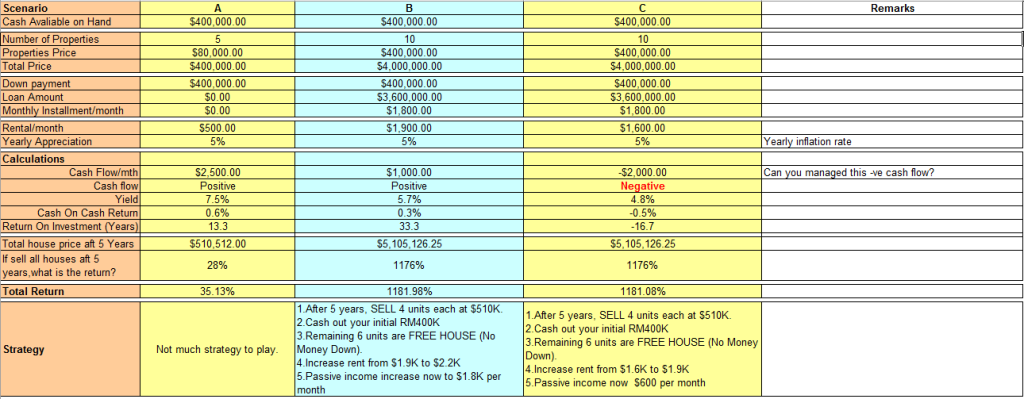

Let examine Jimmy case with below 3 scenarios:

Compare scenario A & B below when you have $400,000 on hand:

Scenario A:

5 unit with $80,000 each buy with cash:

Monthly Installment=0

Rental = $500

Capital appreciation is 5% per year.

Scenario B:

10 units of $400,000, loan 90% (max),Down payment 10% each unit.

Monthly Installment=$1800

Rental = $1900

Capital appreciation is 5% per year.

Scenario C:

10 units of $400,000, loan 90% (max),Down payment 10% each unit.

Monthly Installment=$1800

Rental = $1600

Capital appreciation is 5% per year.

Conclusion:

Based on the Scenario, which is better,which is BEST? There is no RIGHT or WRONG depending on the individual. Investing is and ART. I will choose the Best Scenario to be B, if not C. I will not go to Scenario A as it will tie down all my cash for better investment opportunities in the future.

After 5 years, you owned 6 units rental properties with fully paid off. The BEST thing is you still have your initial $400,00 on hand. Then you can used the seed capital $400,000 to look for few more properties. Just repeat the formula for the next two cycles.

Scenario C has to manage EXTREMELY careful in order not to be caught during the down turn. So Scenario C is RISKY. DRAFT the GAME Plan well. PLAN FOR THE WORSE & Hope for the BEST.

Your comment and feedback are welcome.

1 comment