Last night, I have a 1-on-1 with an old friend that back from Johor for long holiday. He is a cash rich person since he work in Singapore and recently the Singapore Dollar appreciated quite a lot. He shared with me a good rental property in Johor Bahru which is worth $600,000 and able to get rental yield of 6%. I told him that go ahead to grab it as is very rare able to get 6% in Johor Bahru now. 6% rental yield it translate to $3000 passive income per month.

However, he said that he want to buy it with cash! I asked why? He said that he do not like to pay the interest to the bank. He will lose the 4.65% interest paid to the bank. He also do not want to pay extra money for the valuation report, loan documents fees etc.

I replied him, “Friend, I know you are cash rich, but your thinking is still an “OLD Man” generation thinking.” I do understand where he is coming from. That is majority of the people thinking due to they do not have other alternative and not train on how to maximize their return. The correct term should be ” Optimize ” the return of your money. How should you let your $600,000 work harder for you.

There is no doubt that 6% rental yield is much higher than put it in the bank. That one I do not denied.

Disadvantages of buying with CASH

What he did not consider are the disadvantages of buying with cash. Below are just three simple reasons

Tying up a lot of money in one asset class.

Lose the financial leverage on mortgage provides, the return rate will be eroded

- No liquidity

- Higher risk of vacancy

- No tax advantage

Advantages buying rental properties with mortgages

By using mortgage it will help to spread once investment across more properties to maximize the return, rather than concentrate everything into one property.

If one property has a void in tenancy, there could still be rental income coming from the other properties. The downside is that there is a mortgage payment that must be met, whether the property is let or not.

The other reason that some investors will take a mortgage against a renal property is that they can set the mortgage interest against the rental income for tax purposes. This is the beauty of it.

What is the alternative?

I spent the next 30 mins explain on how he can maximize the return and capitalized it. Since he would like to invest all his $600,000 in real estate, I shared with him that he is able to buy 6 rental properties.

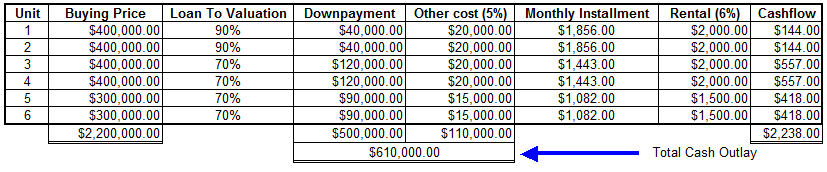

According to Malaysia Bank Negara rules, first 2 properties able to get LTV (Loan To Valuation) of 90%, subsequent will be 70%.

Assuming that the closing cost includes agent fees, legal fees and miscellaneous is about 5%, with 6% rental, the total passive income will be $2238 per month. The total cash outlay will be $610,000 which is $10,000 more than the initial plan. However, here just an illustration purpose. Comparing to buying with Cash of $600,000 and able to get $3000 income per month.

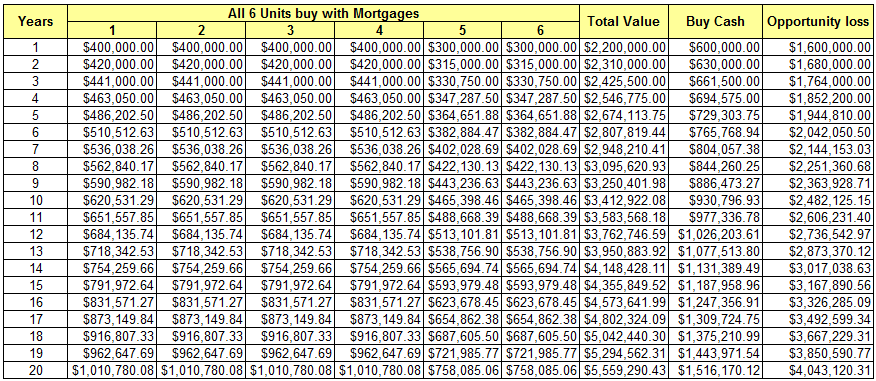

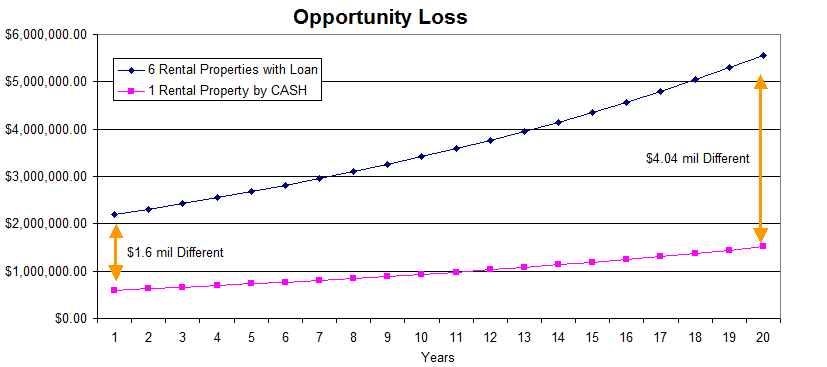

One important point to take note is the total asset value you had acquired is $2.2 million if using mortgage Vs $600,00 if by cash. This will be the powerful compounding for the next few years. Assuming that the inflation rate per year is 5%, the property price will appreciate at 5% as well. Below table showing how much the differences between a person buying 6 properties with leverage compare a person buying with cash.

It is clearly that the gap will be widen as years goes by and it will become wider.

How about the rental gained after 20 years?

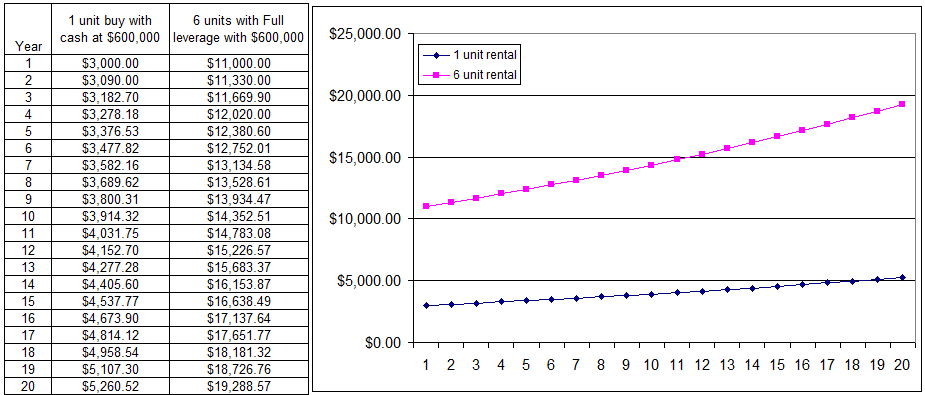

How about total rental of the 6 rental properties at the end of 20 years? Assuming that the rental rate increment is 3% per year, I just put a conservative number which is lower than the inflation rate, the Total 6 units rental will be $19,289 at the end of 20 years. Whilst for the initial one unit of $3,000 rental per month, the rental will be $5,261 at the end of 20 years.

Do not forget that the throughout the 20 years, the 6 rental units monthly mortgage are paid by the tenant. After 20 years, all the 6 units are fully paid off if your loan tenure is 20 years.

Let said you start to bought these 6 units rental properties at the age of 40 years old. At the retirement age of 60 years old, you are taking in $19,288 rental income per month with $4 mil worth of properties. Do you see the huge differences and opportunity loss if you buy your rental unit with cash in the first place?

If you need to cash out your initial $600,000 to enjoy your retirement, just sell off one unit of your property and easily can cash in more than $750,000. The rest of the 5 properties become No Money Down properties after 20 years.

Conclusion:

So to pay cash to buy the property and enjoy $3000 passive income every month or borrow from bank, the decision is up to you. Ask yourself which will provide the greater return on your investment with the same amount of capital.