SME Mortgage Loan – INVESTMENT HOLDING COMPANY (IHC)

Everyone is talking about IHC nowadays for property investment.

What is IHC? Does IHC is suitable for you?

Consider that you are not well versed at IHC, Let us shed some light on this and share with you the GEM and POWERFUL TRICKS of IHC.

Why consider IHC?

1. Condolidating properties under personal name

2. No capping on mortgage loan margin

3. Under individual as guarantor, immediately can apply for mortgage loan financing upon registration of company

4. Under company as guarantor, need to have minimum two years audited report

5. For risk management

6. For taxation

Besides, for JV investment, IHC can be do better in handling the following risk management :

1. Death of any partner

2. Lawsuit againt any partner

3. Conflicts among partners

4. DSR (debt service ratio)

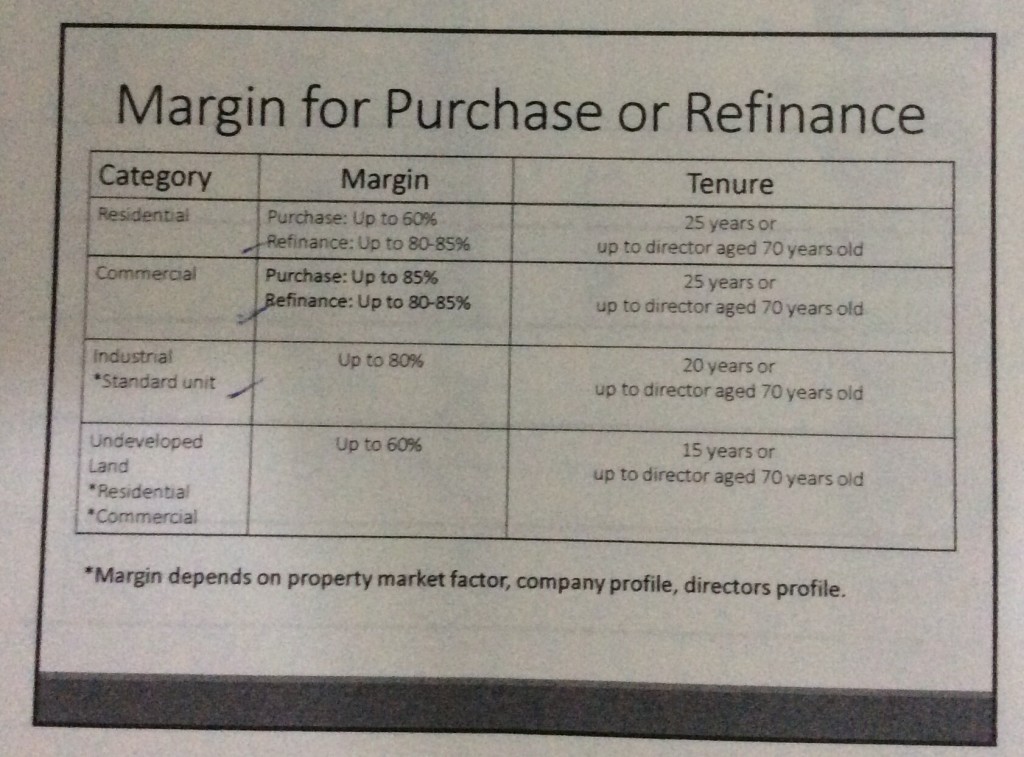

MARGIN FOR PURCHASE OR REFINANCE

Fee & cost involved:

1. Loan agreement fee and stamp duty

2. Valuation fee

3. Key man insurance/investment

4. Processing fee

For us, the above cost means nothing if there is alreafy equity in the existing properties for refinancing.

The only consideration point to set up an IHC for property investment is the annual maintenance cost of RM4k-5k.

What we found IHC IS REALLY POWERFUL TO UNSTUCK our loan eligibilty when:

1. Existing esidential under individual at LTV90% or LTV70%, which already no loan lock in period (usually 3 years) and properties already have equity under LTV 80% loan for current bank value (best if rental yield is at 6% as well based on current bank value), REFINANCE these properties to IHC with 80%-85% LTV!

2. Purchasing commercial properties, why?

Because of margin of finance is the at 80%-85% whether under individual or company.

Residential property

First property – LTV 90% (individual); LTV 60% (company)

Second property – LTV 90% (individual); LTV 60% (company)

Third property – LTV 70% (indovidual); LTV 60% (company)

Commercial property

First property – LTV 85% (individual); LTV 85% (company)

Second property – LTV 85% (individual); LTV 85% (company)

Third property – LTV 80% (indovidual); LTV 80% (company)

Furthermore, if the commercial property is a JV purchase, it is wiser to use IHC.

Eg, shop lot at RM1,000,000 (JV of 4 investors)

MOF 80% at RM800,000

20% downpayment : RM200,000

Investor A : RM100k

Share : 50%

Investor B : RM50k

Share : 25%

Investor C : RM20k

Share : 10%

Investor D : RM30k

Share : 15%

In IHC, share is transferable among investors.

In conclusion,

1. If were to buy residential properties, buy under individual name at LTV 70%-90%, wait until there is equity, then only refinance to IHC with LTV 80%-85%.

Which mean, the LTV90% quota will be made available again and DSR under individual profile will be made more qualify to purchase the next residential property.

2. If were to buy commercial, might as well use IHC.

As the individual DSR as guarantor under IHC will not connect to stand alone individual DSR, and vice versa; when apply for mortgage.

36 comments