Recessions and falling home prices aren’t anything new. Housing prices took a nosedive during the Sub prime crisis in 2008.

Since last Jan 2019 till now, I heard a lot of people out there telling that the Property Yield is dropping. My last purchased of property was on Dec 2018 and only get the key on Feb 2020. This is the longest processing time for this unit due to challenges to deal with the owner for below market value. However, it was managed through and ended with happy note. Below is some of the details of the deal:

Property Name: Desa Permai Indah

Size: 950sqft

Market valuation: RM400,000

Purchased Price: RM305,000

That is 23% below market.

The rental there is about RM1100 per month. So the yield will be 4.33%

If buy at RM400,000 in 2017, the yield will be 3.3% only.

From the above simple calculations, the yield is increased based in the current slump market.

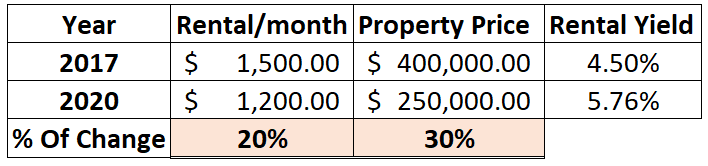

Another dimension to look at the property yield now by illustrating both rental and property price are down.

From above table, you can see that both Monthly Rental and Property price are down for 20% and 30%. But the yield is increased 1.26%. This table will able to give a clearer picture on why invest in the market down turn will increased your return.

Advantages of Buying Properties During a Downturn

- Property prices are normally lower, is a buyer market

- Owners who are willing to lower their asking price

- Interest Rates Are Lower, Currently the OPR rate for Malaysia is 2%, the lowest in 10 years

Drawbacks to Buying in a Housing Recession

Not every home you spot for sale will be a good deal. Some of the lowest-priced homes will be those that require repairs, so you should be able to tell the difference between a major rehab or a home that just requires small cosmetic fixes.

So, by lowering mortgage rates during a recession, the federal government hopes to buoy home sales by making it cheaper to borrow mortgages.

Disadvantages of Buying Properties during Downturn

Not every property you spot for sale will be a good deal. Just like the Desa Permai Indah that shown above, even though with the 23% below market, it require repairs, so you should be able to tell the difference between a major renovation or just requires small cosmetic touches.

Final Advice

During economy downturn, Cash is King, always have six month reserve in cash for emergency used. During an economic crisis, this will give you a safety cushion and allow you to buy assets at low prices.

In order to minimize any losses during a crisis, invest more in residential real estate than in non-residential. Past experiences of crisis have shown that residential property retains its value to a much greater extent.

Avoid investing all of your capital in one asset, do all your due diligence before putting your money into it. Remember, no one care more than you do for your own money.

“You cannot have a positive life and a negative mind.” —Joyce Meyer