Banks are keeping a close watch on their oil and gas (O&G) loan books following the 50% decline in oil prices, say senior bankers.

And so happen, last week, I had a chance to yamcha with one of my friends, who is the real estate negotiater that specialize in Kiara Hills and Kiara View. Many of the home buyers here are either from oil & gas or banking industry.

These are landed properties located between the Mont Kiara enclave and Desa Sri Hartamas. It consists of 2-storey and 3-storey semi-detached and bungalow houses that are built on a Malay Reserve Land.

Properties in these areas are highly sought after due to the prestigious Mont Kiara address and affluent neighbourhood. Not many people can even afford to own a condominium unit in this neighborhood, let alone a landed property.

“Bankers are undertaking stress tests on these loans. Our tests so far show that things are steady and it should not be a worry. But if the oil price drops to below US$40 per barrel, then it could have an impact on our books,” says a banker, who is in the senior management team of a large Malaysian bank. “We are closely monitoring loans from the O&G sector,” the banker adds.

Brent crude fell 50% to touch US$57.10 per barrel recently from a high of US$115.06 last June. It started falling after hitting a high in June and has been on a downward trend since then.

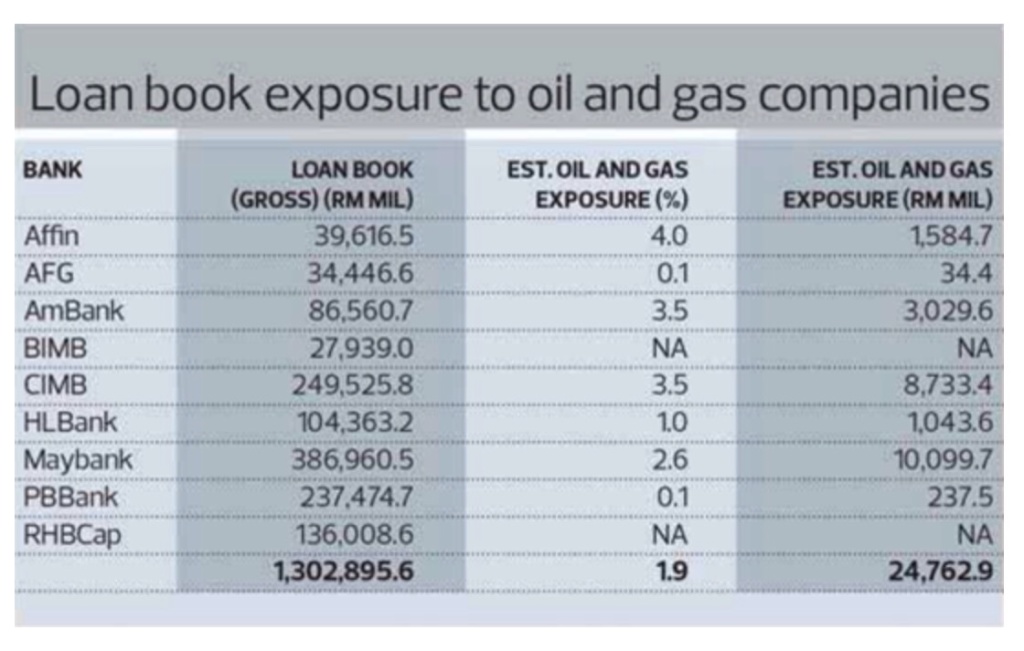

Kenanga Research, in a Dec 30 note, says upon cursory checks with the local banks, it seems that Affin Holdings Bhd (with 4.0% of gross loans exposed to the O&G sector), AMMB Holdings Bhd (3.5%) and CIMB Group Holdings Bhd (3.5%) will be hit the hardest as a consequence of the oil price weakness (see table).

So, possible good buy when there is crisis in oil & gas?

Note: It can only be bought and owned by the Malay community as it is built on Malay Reserve Land.

Taken and edited (Source: The Edge Malaysia)