When I said everyone can owned 5 rental properties through out your working life is an easy task, no one believe me. They will said buying a single house already is a burden with current sky rocket price. None of them believing what they can do actually. Thinking that owning 5 rental properties requires million Ringgit.

I do strongly believe you have friends or family members has owned this number of rental properties. Maybe you just did not ask them or they did not shared with you on their holdings. Now let me shared with you how to do that.

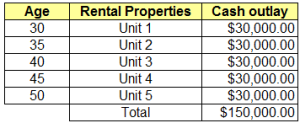

When you graduate from university and started your career at the aged of 25, you have to start to plan ahead. The strategy is simple and is achievable. The strategy is to buy 1 property every 5 years. How to execute it?

Save money for your first property

Once you start your career, on the first month you need to start saving $500 every month for the next 5 years. How much would you save?

Total saving = $500 x 12 months x 5 years

= $30,000

At the age of 30 years old, you have save so much money in 5 years, now you can buy a property that worth below $300,000 properties. $30,000 can be your 10% down payment for your 1st property. After that, rent it out for positive cash flow and you will having additional income.

Do not stop your saving after fifth year, keep continue your saving for $500 per month every month. The consistency is the key for your success.

If your 1st property having excess cash flow, you may added in to your saving to grow your investment fund faster. At the age of 35 years old, you will be buying your 2nd rental properties. Repeat the same formulae until you have acquired 5 units of rental properties. What age will it be? You will be 50 years old when you buy your 5th properties.

How much is the cash layout for 5 rental properties?

Your total cash outlay for your 5 units rental properties are just $150,000! Is it easy or tough?

The strategy is too slow?

Some of you may said that 5 years plan is too slow. Then you can increased the amount of your saving to any number. If your initial salary is high and able to save $1000 per month, then you will be doing faster and better compare to others.

What if I am too old at the age of 40 years old?

Maybe when you read this article, you are already 40 years old. I believe you have an established career and good income by then. You may have substantial saving in your bank as well. If looking at the table, at 40 years old, you should have 3 properties. In that case, you should be able to go out and hunt for another two more properties. You just need to catch up the plan that you may lost. Remember that the time is the essence for saving in early age.

Bear in mind that the above illustrated strategy is just a simple concept that can be employed by anyone. You are free to change any number to fit to your own individual pace. You can slow down by saving less or speed up by saving more. The ultimate here is to EARN as much as you can and AS FAST AS you can!

Any other alternative?

People also always ask me how to buy properties without money, because a lot of “Gurus” out there applying this method. Yes, there are quite a few method, if you are interested to know, I have compiled a few tactics in an e-book, you may download it by entering your e-mail address on the top right corner.