When at the end of 2014, government announce there will be fuel price drop for RON95 and RON97 beginning of the new year. We all as Malaysians are expecting huge reductions from 1st Jan 2015 onward.

Towards the end of 2014, I suffered a major setback due to my car had a major breakdown.My car had spent about three weeks in the workshop and I have no choice but to car pool with my colleague to office. I still remember on 29th Dec, he mentioned that if his remaining petrol can last till 1 Jan 2015 so that he can pump cheaper fuel. It is only the last quarter of the tank. We still have 2 days to go with 120KM for 2 days.

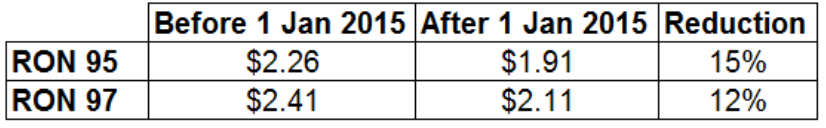

Bear in mind that the price for RON95 is $2.26/liter whilst RON97 is $2.41/liter.

Since my car still in the workshop, 1st Jan 2015 I still car pool with him. Early in the morning, he went to pump fuel in the nearest petrol station. I was little shock to know that he is pumping RON97 which cost $2.11/liter now. Refer to table below for the fuel price drop percentage.

Then I asked him, “Why do you usually pump RON97 for your car?” He replied, “Not really, I pumped RON97 because the fuel priced has gone down now.”

Now he claimed that his car can used higher premium fuel thanks to the lower fuel price.

I am little bit disturbed with the remarks. Initially want to save few dollars just because want to save some money. However, when the fuel priced drop, pumped in the higher grade of fuel. Let us do some maths here.

Assumption:

Full tank capacity = 50 liter

Cost to Pump full tank on 30 Dec 2014 for RON95= 50 x $2.26 = $113

Cost to Pump full tank on 1 Jan 2015 for RON95= 50 x $1.91 = $95.50

You will be enjoying 15% fuel price reduction.

However, if now pump the RON97, what will be the saving?

Cost to Pump full tank on 1 Jan 2015 for RON97= 50 x $2.11 = $105.50

The reduction is only 7%.

Managing your extra saving from fuel price drop

I am not really comprehend well on the above scenario which only will be saving about 7% when fuel price drop. Theoretically can have great saving at 15% but in reality only 7%.

Assuming that my monthly fuel expenditure is $1000 in Dec 2014 due to work commitment, this month I could have $150 extra saving. Some one may ask below two questions:

Q1: What can $150 extra per month impact my lifestyle?

Q2: What can I do with $150 per month?

Both are an easy questions to ask, but there is no straight forward answer to it. For me, if no one put in a deep thought of what can $150 do for you or impacting your lifestyle, there is nothing much help can be done even the fuel price drop till $1.30 per liter. This is due to whatever money saved, it will be spend anyway.

The important thought will be:

- What can I invest with $150? or

- What can I buy with $150?

One is delayed gratification whilst the other is want to enjoy instant gratification.

The money management mindset is not properly tune yet. If you have any suggestion what can you put to good use for $150 per month, feel free to write to me.

Where to get my capital for my first property?

When I ask the youngster who had worked for three to five years, why you still not buying your first property? The answer seem to be uniform, “I do not have capital for the first down payment.”

By referring to the above example calculations, you will immediately have $150 per month as saving. For example, if you can save $150 per month, and consistently for 5 years which is 60 months.

$150 x 60 months = $9000

With this amount, it sound that the amount is too small. However, do not forget that this is just the extra you are able to save from the benefit of fuel price drop. You can make it a habit to add this amount $150 to your existing saving.

Last but not least, in order to grow your wealth in any area such as property or paper asset, first you need to focus on your saving. Accumulate your initial capital and think of a way to grow it in the fastest way.